Chase recently rescinded their Price Protection benefit for their most popular cards, Citi made changes to their Price Rewind program as well. But where Chase removed the benefit entirely, Citi adjusted it but kept it in place. Chase’s misstep offers Citi a chance to step up.

If you are considering booking travel or signing up for a new credit card please click here. Both support LiveAndLetsFly.com.

If you haven’t followed us on Facebook or Instagram, add us today.

What is Price Protection?

Many credit cards offer some form of Price Protection, a feature that allows customers to get a refund when prices drop without having to return and repurchase the items at the store. The process before price protection (and one that still remains in effect for any card) was to purchase an item, watch for any changes within 30 days (or whatever that retailer offers) and bring the product back for return with a receipt then repurchase at the newer lower price. Some smart retailers will allow customers to just bring back the receipt and make the adjustment back to the method of payment without returning the merchandise and re-purchasing. This saves them time returning a perfectly good product for repackaging or taking a loss by re-selling it as an open-box item.

Price protection simplified the process even further. I personally, failed to use it more than a couple of times over the last few years because the process was a little complex and I don’t typically track prices after a purchase has been completed. But then, price protection expanded to more cards as a benefit (like TSA Precheck/Global Entry fee reimbursement and Priority Pass lounge access) and the process became simpler.

In its current state, refund forms can be filled out online and processed back to the card with ease without ever returning to the store. Some require uploads of the affected billing statement and the lower advertised rate.

Bad Actors

Re-sellers who use their cards to purchase huge inventories of items on their credit cards and then re-sell them online are part of the problem. They are a victim of their own success. For example, if a re-seller purchases 100 Rowenta irons for $30 that are normally $60, and then the price drops to $28 (even for a quantity of 1), the re-seller is entitled to the $2 for every purchase they made, $200 on their $3,000 purchase. When the re-seller goes to put the irons back on the market (usually Amazon) and prices have returned to normal, they can make $30/each or price under the market rate to move them quicker keeping the price adjustment as well.

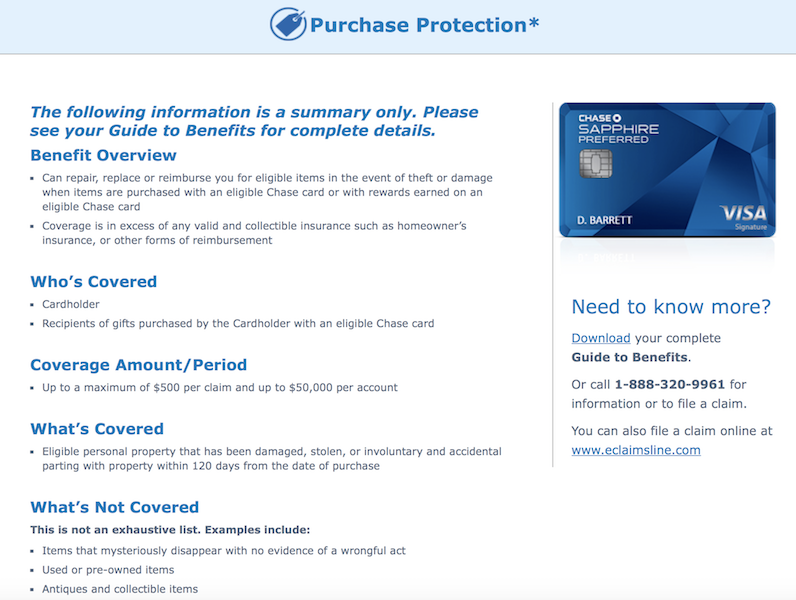

While the re-sellers have a hand in the demise of what was a nice protection for consumers they can’t be blamed entirely. For true consumers, it would have been difficult to hit the limits in price protection during a given year without doing home renovations as the limits were high ($500/claim, $50,000/year for Chase Sapphire Preferred). But for lower fee cards ($95 for Sapphire Preferred for example) given the other benefits included, a few claims would start to add up.

Rise of the Bots

Then came the bots… Automated tracking and processing of claims by bots like Earny file the claim for you (here is my referral link if you choose to sign up). While this isn’t a commercial for their product, I do love it for Amazon purchases which are likely to see price changes and their process is really easy. Earny (and others like Paribus and Coinfetch) gain your permission to access your accounts and track purchases within a given window (90 days in some cases). When a price drops, they automatically grab the receipt, the new advertised lower price and submit the claim on your behalf.

Earny keeps 25% of your claims, but for me, it’s found money. I don’t have to do anything but purchase and keep it installed. The checks come in and most of the time they aren’t huge. I’ll get a check for $1.00 off a book that bought, $5.97 off of air filters two weeks ago, but occasionally a good one comes in, like $60 off of $200 for an expensive Moleskin smartpen. They also refund the whole amount back to you and charge their fee separately, which helps to earn miles on those refund expenses as well.

You could process these claims on your own and receive 100% of the difference, but I don’t do that. The key to Earny is that there is a lack of required effort on my part. They navigate the price protection process so I don’t have to because frankly, I wouldn’t.

Chase Changes

A few of the Chase cards offered this service through the aptly named, Card Benefit Services. The United card swapped some benefits and among them sacrificed Price Protection. Then Chase Sapphire Reserve and others. We don’t sell credit cards on this site so I can say unabashedly and without incentive that the Sapphire Reserve is my go-to card. If I buy airline tickets on a carrier where I have also have their co-brand credit card I may use that one instead, or AMEX if I am buying something where I need an extended warranty like a laptop (CSR offers the same benefit but I have found AMEX customer service to be better in instances where I needed to file a claim). But the card I draw as a default is the Reserve. That was true until Chase decided to take away the benefit entirely. This dropped the benefit for me from worth a couple of hundred dollars every year to $0.

Citi Changes

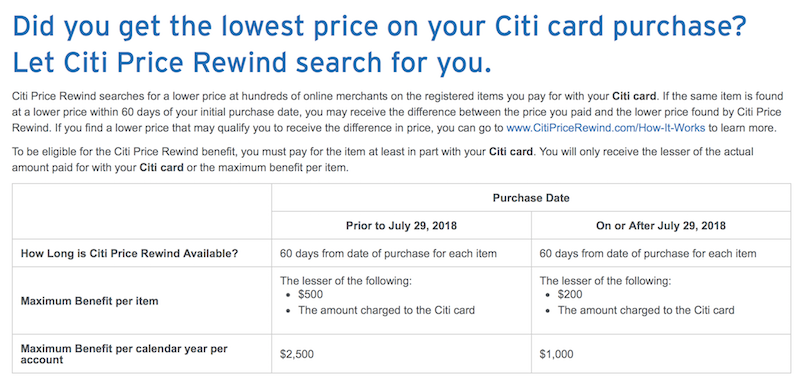

Citibank offered a similar benefit, Price Rewind which had lower limits than the crazy-high $50,000 annual limits of Chase Sapphire Preferred. Instead, the limits were limited to $500 per claim and a total; of $2,500/year within 60 days of purchase, reasonable in my opinion. As of July 29, 2018, those limits drop to $200 per claim and $1,000 cumulatively through the year.

While it’s clear that both Chase and Citi are getting more price refund requests than they had anticipated, by Citi keeping the benefit in place, I still stand to claim as much as $1,000 though probably closer to $300 if my spending habits work the same. I have not used Earny with my Citi card yet, but Earny does require a Visa which can be hard to find with Citi. Their Price Rewind has been helpful on occasion in years past, but I will seek bots that work like Earny for my Amazon purchases.

What Am I Changing?

For purchases on Amazon (and we purchase a lot from Amazon) I am going to switch to another card that still has a price protection feature and works with Earny. So far this year, Earny is on pace to return to me about $300 and when you factor in the annual fee for the Chase Sapphire Reserve ($450), it pays for 2/3rds of the card on its own.

Consider what that costs Chase in business. The processing fees alone are probably somewhere in the range of 1.5-2% and for retailers other than Amazon may reach 2.5%. While I am in no way a power user or a re-seller, moving my $4,000 in spend on Amazon every year to another card will cost Chase more than the processing fees on that money. If I carried a balance (don’t do that if you can avoid it) they would also lose out on the interest as well. At a minimum, Chase is losing out on $60-100 in revenue simply because I choose to charge on another card due to Purchase Protection. If I carried a balance or paid late (seriously, don’t do that either) they could lose out on $35 every time I forget to pay my bill and any of the interest accrued.

Gary Leff talks about how credit card companies want to be top of wallet. They want to be the card that Chase Sapphire Reserve was in my wallet, the one I use for everything unless I have a specific reason to use something else. Consumers, like myself, do not want to carry 30 cards in their wallet using one for gas, one for groceries, another for online purchases, another for travel, etc. They will do what I do and occasionally draw another card for specific purchases, but for the most part, they want to manage as few cards and balances as possible.

Chase had that for me, they’ve since lost it and that’s hard to get back.

What do you think? Did Chase get it wrong? Were they right to eliminate the benefit? What about Citi? Does it make the benefit less useful? Will you change your own purchase habits as a result?

Limit the frequency cardholder can apply, add a minimum hurdle for claim, only accept paper claims, or combo of those.

I agree, keep it around in some form rather than get rid of it altogether. Maybe they will walk this back as they did with the IHG Anniversary night.

** Chase’s misstep offers Citi a chance to step up. **

Headline says they did step up. And that’s the level of consistency I’ve grown to expect from the things posted here.

Veronique, Chase did misstep (eliminating the benefit entirely) and Citi did step up (keeping the benefit in some form, even if diminished in scope).

You forgot to point out that Chase will also miss out on the $450 fee you pay per year, so they’re actually missing out on even more revenue.

Well, I won’t cancel the card as a result so they won’t lose my annual fee just some of my spend.

Kyle, it’s curious that you mentioned the price protection changes, but neglected to address the rest of the changes coming to the Citi Prestige. I read on TPG the other day that they’re cutting back quite a bit. Their biggest advantage, the 3-hour trip delay, is going away. I think it would’ve been better if you wrote a more complete comparison of both cards, since they’re both reducing benefits.

I wasn’t speaking to any specific Citi card, and with Chase only used the Sapphire Preferred as a reference point; I am not comparing two cards but rather the two banks. Chase went from far too generous to removing the benefit altogether, affecting reasonable people like myself who prefer price protection to none. Citi, also experiencing problems with an influx of claims decided not to completely take away the benefit but rather lowered their exposure.

Price protection was the only reason I used my Sapphire Reserve card for shopping purchases. Now since they cut that benefit, I have decided to move all of my non-dining and non-travel spend to my Citi Double Cash card for a straight up 2% cash back. I was forgoing a half cent of rewards by using the Sapphire Reserve for shopping because I knew I had price protection. Not anymore.

I am with you Brent, great point.