If you are considering booking travel or signing up for a new credit card please click here. Both support LiveAndLetsFly.com.

If you haven’t followed us on Facebook or Instagram, add us today.

In case you haven’t heard, there have been some recent setbacks in the world of mileage earning debit cards, but it’s not all bad news. In fact for many consumers it’s better than it ever has been.

For those pursuing credit card style earnings of one mile for $1 spent, the opportunities are much worse. Many that have admitted being among the most prolific abusers of this type of account (manufacturing tens of thousands of dollars in spend and thusly miles per month) will not enjoy their options – I was one of those people for many years.

For brevity the accounts that still offer points based on spending are Hawaiian Airlines Bankoh debit card ($2 = 1 mile), The UFB Direct Air Miles debit card (American Airlines, earn rate of $3 = 1 miles), and for those that already hold the Sun Trust Delta debit card ($2 = 1 mile) – all of which have limitations that reduce their value to nearly nothing for consumers who are trying to spend their way to a free ticket on a debit card (some of which have limits and costs).

However, many consumers that choose debit cards make those choices for a variety of reasons that include miles but are not purely for the exponential spend to exponential miles ratio. For example, some users of debit cards simply want to find value in the form of miles at every stage of their financial lives. Small ongoing spending that earns points is good enough to satiate this desire, for them the UFB debit card might be enough.

Others, they are simply wary of pursuing credit cards for the purpose of churning or are cautious for reasons like preparation to buy a home – for them, one-time bank bonuses offered by Bank of America, Citi Gold checking and BankDirect are perfect. In fact, for those earners who are not genuinely spending $25,000, $30,000 or even $40,000 on a debit card every year, the current bonuses offer an amount of miles they would not otherwise achieve (even under the old 1:1 system). For them, the shift to bonuses over spending based earning of miles on debit transactions is far better than what they would achieve otherwise.

That’s important. That’s substantial. And frankly, that’s the majority. I get emails and comments on my many posts about debit cards (and if you have questions please tweet me @tripsherpa, comment here or email me @kyle@upgrd.com) from customers who do not feel comfortable with a churn approach to miles, points and cards. There is nothing wrong with that, there’s actually an awful lot right with that approach.

In case I have not made it clear below here are the take-aways:

- Manufacturing spend on a debit card through the buying of gift cards, money orders or using Bluebird to generate that spend from a mileage earning debit card has mostly lost it’s value.

- Bonuses for those who are pursuing miles without spending-based incentives (some call them bank bonuses) are better than ever, more prevalent and turn out a better result for the majority of customers with whom I have spoken.

Let’s break down the current choices for non-credit card mileage earning accounts…

Sun Trust Delta Debit is Dead, So is UFB Direct

I extensively covered the Sun Trust Delta Debit card in previous posts and it was a card I liked. One I liked even better was the UFB Direct Airline Rewards card which gave American Airlines miles. Both were very fruitful for me to the tune of a combined 230,000 miles – a significant value for my money.

But Sun Trust Delta Debit is really, really dead (and so is Delta) so it’s time to ditch them both. The UFB card is one that will be impossibly difficult from which to gain value. Before I get into what happened to the UFB card (not recently covered) there are clear differences I want to identify between three types of accounts.

Account Types

- Bonuses for Sign-up or Activity Mile Markers

- Points for Purchases, Spending-Based Accounts

- Points for Balances, Interest-Based Accounts

Both UFB Direct and Sun Trust Delta Debit are spending-based accounts and that category is mostly dead. There is a Hawaiian Airlines debit card that earns pittance and the bank is impossible to work with in my experience.

For now, let’s just forget about spending-based accounts because they have pretty much forgotten about their customers, and frankly, it’s just not worth the effort nor time/cost.

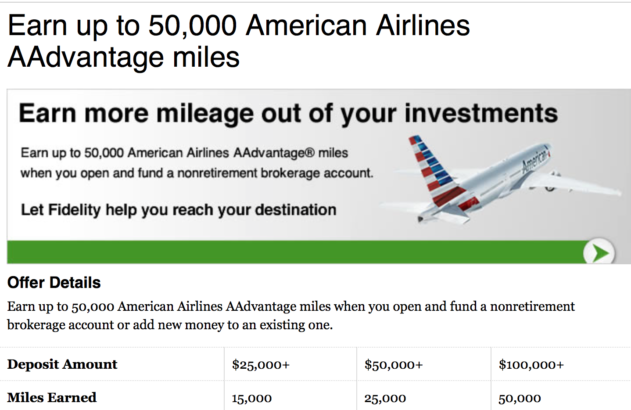

There are also accounts that will pay out miles instead of interest or in a combination of a cash percentage (lesser than the going rate) and miles. Fidelity runs an incentive to get new brokerage accounts in the door. Instead of parking your money in a savings account you can open a new Fidelity Brokerage Account and make no interest but earn between 15,000 and 50,000 miles of your choice.

At current savings rates the miles are probably a better deal if you spend them wisely. For at least the next few months (likely devaluation coming soon), American prices an entire round-trip to Japan for 50,000 miles. Assuming you have lots of money to park with Fidelity the rate of return on $100,000 for six months could exceed 1% (replacing about a $1,000 ticket to Japan) but I doubt it.

Let’s assume you don’t have that kind of cheddar to just throw into an account and leave it.

BankDirect is a great solution. They have a combination of thresholds to cross and pay out miles instead of significant interest. They pay out 100 miles per average $1,000 you hold in your account. Even those with small savings or one-time disbursements can do well with this checking account. Let’s say you had $5,000 in cash savings, moving it to this account would already make more sense than buying the miles outright ($12/month maintenance fee) at a value of 500 miles for the balance. The sweet spot is $50,000 to hold as a balance in the account but few have that in liquid cash to just earn miles for them, there are other ways to earn miles but you need to be fairly active in your account. Here is a list of ways to earn:

Lastly, there are a couple of accounts that post one-time bonuses after achieving some mile marker in the program. I covered the Citi Gold bonuses that closed last month, and lucky for you – it’s back! Just spend $750 on the debit card, and make two bill payments, one in each of two successive months for any amount and it’s all yours.

There is another option and that is the Bank of America Alaska Airlines checking account. I am currently validating what works for direct deposits with this account type. You should probably sign-up anyway because it states the offer is only valid until July 31st, 2015.

The offer is 25,000 points paid out in a single bonus of Alaska Airlines Mileage Plan miles once the second of two direct deposits totalling $2,000 each are made. While it would seem that Bank of America would only target serious earners with this income requirement I have asked and had it documented that $2,000 in net direct deposits over two deposit in the same month is still eligible.

Their current set-up is a bit naive. They are striving for earners that make at least $75,000 per year as most earners get paid twice monthly, but that also assumes that they do not take any additional health insurance, set asides, garnishments of any kind, of 401k deposits. However, their imperfect system could give the same bonus by attracting people that are paid just once per month and only make $32,000/year. As my day job is in sales, 30% of my income is salary and the other 70% come in quarterly bonuses so while I should be a great target for the bank, their structure of only issuing rewards based on the direct deposit numbers penalizes me or other commission-based earners.

Unfortunately, I have not successfully posted the bonus yet as I am just starting this account, so if you are on the fence you should sign up for the account. It’s free and the offer ends soon.

As always, if you have questions on the topic of debit cards feel free to email me directly as many of you have: kyle@upgrd.com – I am happy to answer your questions as debit cards have provided me and many I know with tremendous value.

-Sherpa

This requirement for the BoA offer would seem to exclude anyone not contacted directly by BoA. Did you find a way around this ?

1Eligibility: Offer only available to customers who receive this offer via a direct communication from Bank of America®

Thanks!

@E – Most of these offers have a stipulation like this, but if you are offered it when you call in to ask about it (like I did), once the offer is made to you it overrides this stipulation. If you call in and they say you were not targeted and cannot sign up then of course that’s another matter, but I have not found that to be the case in my experience.

If they let you sign up for the offer, the onus is the bank’s at that point.

Thanks for reading the blog E, I hope this is helpful.

-Sherpa