If you are considering booking travel or signing up for a new credit card please click here. Both support LiveAndLetsFly.com.

If you haven’t followed us on Facebook or Instagram, add us today.

The title is only a partial stretch. You need to sign up today, you will receive the miles in as soon as 31 days. Let me walk you through how this is possible and why it needs to happen urgently.

CitiBank Gold Checking

CitiBank is offering the sign up bonus with your choice of miles or points but the offer closes tomorrow. June 30th, 2015. It is possible they will re-open the offer again in the next few months, this offer comes and goes, but unarguably this is the best time to earn and burn American Aadvantage miles before the devaluation occurs.

The offer is a bonus, just like a credit card offer, but there is no offer for credit, no credit check whatsoever. There is a “soft pull” meaning that your credit information is used to verify your identity with questions like, “Which of the following cars did you own?” or “Which address have you called a residence?” and then lists of options. One of these questions is usually incorrect or the answer is “none of these” and there are 3-5 questions.

The account itself is for a premium checking account and depending on where you live and what your spending patterns are, this might be very valuable to you. For example, if you live in a city where CitiBank has lots of ATMs and you find yourself (with another bank card) pulling out cash a few times per month and incurring a foreign ATM fee, it may make sense to continue with the account.

Normally this enhanced checking account, which genuinely has some of the best customer service in the business, costs $30/month (unless you keep a balance of $50,000 in cash or have certain Citi mortgage accounts). However, the first two months are always comped which conveniently is the amount of time it takes to fulfill the requirements of this account and receive your bonus.

Requirements

- Spend $750 in debit card transactions (can be processed as debit or credit by the business)

- Make one bill payment for two successive months

That’s it. No upfront fee like with the old SunTrust Account, no ongoing monthly fee like BankDirect, just fulfill the criteria and you’ve qualified for the bonus. You also do not need to be in a city where CitiBank has branches and apply in store, this can all be done online.

If you are considering the Citi Prestige card you can also deduct $100 from the annual fee on that credit card just by being a member.

Sign-Up Link and Process

- Go to the following link: http://banking.citibank.com/cbol/DM_codeEntry.htm

- Select CitiGold and enter the following code: 4Y6KEW8XL3

- Complete the sign-up process.

Your application will take a couple of days to process and over the course of 7-10 days you will receive your debit card. Sometimes the PIN arrives separately, and sometimes it does not. For my wife and I the PIN did not arrive automatically though we were very patient. We had to call in and request it be sent out, not a replacement, but the initial PIN. Some representatives said this was normal, others said it should have arrived. As soon as you get your card, I would call and request the PIN.

Once you have your card and the PIN the following should be done to complete your account:

- Fund the account with at least $752, but really as much as you want. Some have reported success in funding from a credit card, but be sure to set your cash advance to $0 first. That will force a decline for any cards that see it as a costly cash advance, or allow it for those that do not see funding the account as a cash advance.

- Spend $750. We did ours loading the Redbird and then paid bills with it.

- Make a bill payment of at least $1, but you should do more just in case you have an issue with the account. It’s pretty hard to defend using the account genuinely and not just for the points if you are making $1 bill payments and Citi is a pretty easy relationship to maintain.

- Wait 30 days from that bill payment and make another for at least $1. These payments can be made to different companies, they do not need to have any relation to each other or consistency.

- Call to request the points credited to your account. They can expedite this instead of waiting for them to naturally process.

- Make a decision to either keep the account open for it’s many benefits or close it. If you close it before the monthly fee hits, you will not owe it and the miles are free.

The Account

I don’t believe in something for nothing, so I usually keep the account open a few months at least because I feel like Citi has recruited my business in good faith and I should show some. In turn, I have had no issues getting the account bonus a second time when I signed up 18 months later for the same account. Their customer service is excellent, they even covered me on a potential ATM withdrawal that I did not take in Brazil and immediately replaced the funds while they investigated, instead of waiting to conclude their investigation. Their customer service is open 24/7/365 and their agents assume that the customer is a valued member instead of assuming the customer is out to get them as I found with SunTrust.

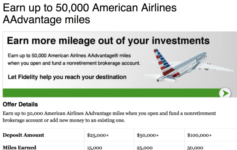

American Aadvantage Miles for Short Term, Thank You Points for Long Term

If you intend on redeeming in the near future, Aadvantage is the way to go. They have not yet adjusted their award chart dramatically as is expected in the next few months. If you plan to use these miles to take a cross country trip, or a flight to the Caribbean or any other cheap destination on the American award chart, you should credit these points to your Aadvantage account.

However, if you do not have any immediate trip plans, Thank You Points (a flexible points currency like Ultimate Rewards from Chase or Membership Rewards for American Express) will ultimately hold more value. You can also redeem Thank You points for cash American Airlines flights at a rate of 1 point for 1.6¢ of value. That makes the Thank You Points bonus worth a $640 American Airlines cash ticket. If you need to make a mileage run, or want to book one of the many cheap fares ($640 or less) to Europe, Brazil or Asia that American is currently offering, this would allow you to not pay anything out of pocket but still earn status, miles and bonuses as a cash ticket would, presenting much more value.

Don’t wait, don’t put it off. Just do it now. It takes almost no time at all and holds serious value for those who prefer debit to credit, and credit lovers alike.

-Sherpa

So I just did it! Everything seemed to go through okay, though I did not enter my AA account anywhere. Is that later on in the process? Hopefully they will link my account to my pre-existing AA CITI credit card?

Can you do both of these offers? If so, how long do you need to wait in between sign up/cancellation?

@Matthew – Congratulations on opening your account, I think you will be quite happy with the results. When you call in for your PIN (do this as soon as your card arrives) then you can point out that they did not ask for your AA account number and they can remedy this. For my account they asked me for it, for my wife’s account they did not. When she called in for her PIN it was added and has had no issues sent.

@Brian – If you are still able to get in on this offer (it expired June 30th but exceptions have been made) you can reapply for either offer in 18 months from when you receive the bonus. However, you cannot sign up for both offers at the same time to my knowledge. If you have tried to sign up for both and were successful PLEASE report back. I didn’t even consider that it might be an option.

I have applied and received the bonus over 18 months ago and already received this current offer bonus, so I know it is able to be repeated.

Just finished this promotion but they said since my account was not linked to a Citi AA card I cannot get the promotion. Please tell me the customer service rep didnt know what she was talking about?

Can you double dip and receive the bonuses for opening both a new checking and savings accounts?

Do you have to have a linked Cit AA card or does having an AAdvantage Frequent Miler account qualifies for the bonus miles?

@Calvin – I am not sure if it is eligible for savings accounts too – you can always try your luck by calling and trying for a savings account. However, I know that you cannot get the checking account bonus more than once in an 18 month so the question seems to be how Citi sees that bonus. If they see it as a “banking bonus” then you might be out of luck regardless of checking or savings, but if it is a product coded bonus you might be alright. I haven’t seen anything advertised about savings accounts so I really couldn’t say.

While it states that you DO need to have an AA Citi credit card to qualify in the terms and conditions, this has not seen any enforcement from several friends and readers that have applied and received the bonus without an open AA Citi card. They could always make it an issue if they wanted, but then again, you would be out of pocket nothing for trying if they decided to deny you the bonus.